It’s well and good reading countless articles on how to improve your campaign. However, there are just sometimes where the best

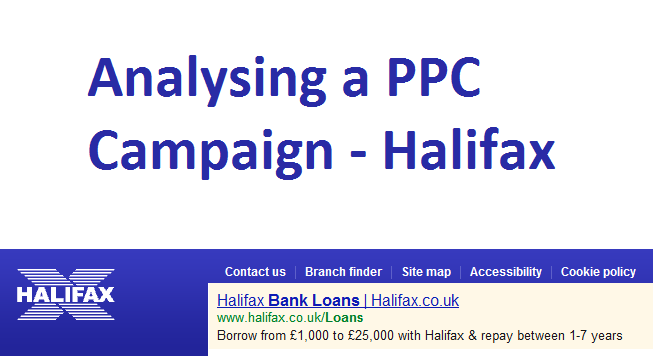

When I types ‘bank loan’ into Google, the first PPC advert results that appeared was from a bank in the UK called ‘Halifax’ with the advert being:

Halifax Bank Loans | Halifax.co.uk

Borrow from £1,000 to £25,000 with Halifax & repay between 1-7 years

Already, you can see that Halifax have targeted their campaign to aim at the UK from seeming to send their campaign to a UK address. They are an English company therefore it does make sense to aim their PPC campaigns towards potential customers in the UK. As well as this, we can gather they have paid quite a high CPC to gain this ad placement and keyword. ‘Bank loan’ is a very general and high paying term in the world of PPC. This is made clear with the description which describes taking out loans between £1,000-£25,000. If Halifax manage to get a good conversion rate of loans from this campaign, paying something along the lines of £50 ($80) per click will seem like pennies for such a huge sale.

After clicking on the advert, you are taking to a page that looks like this: ( to go to it)

Halifax’s landing page is one of internal links showing how they want you to buy other products/services from them. You have come to the page due to wanting a bank load. However, after seeing the ‘Home Improvement’ link, you might want to click on it too and check that out too. In simple terms, Halifax have bombarded their landing page with other links which are related to the reason you came to the landing page – clever.

As well as this, there is the obvious that Halifax wants you to perform an action (and if you successful do so, that will be a conversion for them). In the case of this PPC campaign, the centre spot of the website is taking up with reasons why you should take a loan out from Halifax from getting free fuel to having fixed affordable payments. From this, Halifax have managed to get targeted geographical traffic to their landing page and then gone into detail reasons why you should buy a loan from then. Also on this page is a loan calculator making it easy to predict your loan expense with the click of a button. This is where Halifax have taken into consideration the average web user. Internet users have a short attention span where if they feel their time is wasted or they are stuck on a webpage, they will simply click away. The problem with gaining conversions through banking is that many people don’t like numbers and the hassle of getting a loan. For this reason, Halifax have tried to simplify the process of predicting and taking out a bank loan making it a lot easier for everyone. This should help keep people on their landing page reducing their bounce and exit rate as well as increasing their more vital conversion rate.

Just from typing some keywords into Google and looking at their landing page, it is possible to produce a break down of an entire PPC campaign. For example, from the above, we can figure out that Halifax:

- Has a high CPC.

- Aimed their campaign towards the UK. They have not decided to introduce globalisation to their PPC campaign yet.

- Want to attract web users to other products on their landing pages as well as bank loans: there is potential for other sales other than bank loans to happen.

- They have a good conversion rate for their well thought out landing page.